Flapper: Stable Outlook for the Air Taxi Sector, Says Industry Expert

There is no doubt that the executive aviation sector experienced a resurgence during the pandemic, with a notable increase in visibility and awareness among many new clients who were driven by limited alternatives and concerns about the virus. The end of the pandemic brought fears that private flights would return to serving only the wealthy and politicians. Contrary to expectations, the sector is thriving due to the modernization of the global fleet and significant funding in the development of the urban air mobility segment, which is still to be launched.

In the article below, we explore five trends in the executive aviation and air taxi sector, highlighted by Paul Malicki, CEO of Flapper, a leading on-demand executive aviation company.

Stable Growth of Private Flights in Emerging Markets

Looking at global aircraft movement data, combined operations of executive jets and turboprops in the first week of July 2024 were 37% higher than in 2019, according to ADS-B trackers. Emerging markets recorded the highest growth rates, led by South America, India, and the Middle East. For example, in the first half of 2024, São Paulo saw a 13% increase in executive aviation flights compared to the previous year. At the same time, Europe experienced a -1.3% decline, according to the data. Separately, Colombian civil aviation authorities reported that air taxi flights grew by 23.5% in 2023 compared to the previous year.

With the post-pandemic market now stabilized, analysts are focusing on markets such as Brazil, with its continental size and established general aviation infrastructure. While unlimited future growth cannot be guaranteed, one thing is certain: the sharing economy will be the primary driving force behind the sector’s advancement.

Air Taxi and Fractional Ownership on the Rise

On-demand services and the sharing economy have successfully revolutionized key sectors of the economy, including mobility, food, and real estate. Executive aviation is next, according to Flapper’s CEO. He argues: “With rising aviation service costs, private aircraft owners are seeking to offset some of these costs with third parties, whether by chartering their planes and helicopters or sharing ownership with others. At the same time, there are increasingly more users looking for 100% ‘asset-light’ consumption models, meaning those that enable booking a private plane or purchasing a single seat without commitment — and technology now makes that possible.”

In July 2024, the total number of air taxi aircraft in Brazil soared to 683, surpassing the 636 units recorded in June 2023 and 608 in June 2022, according to ANAC data. Greater availability of the commercial fleet means more competition and better offerings for the end consumer.

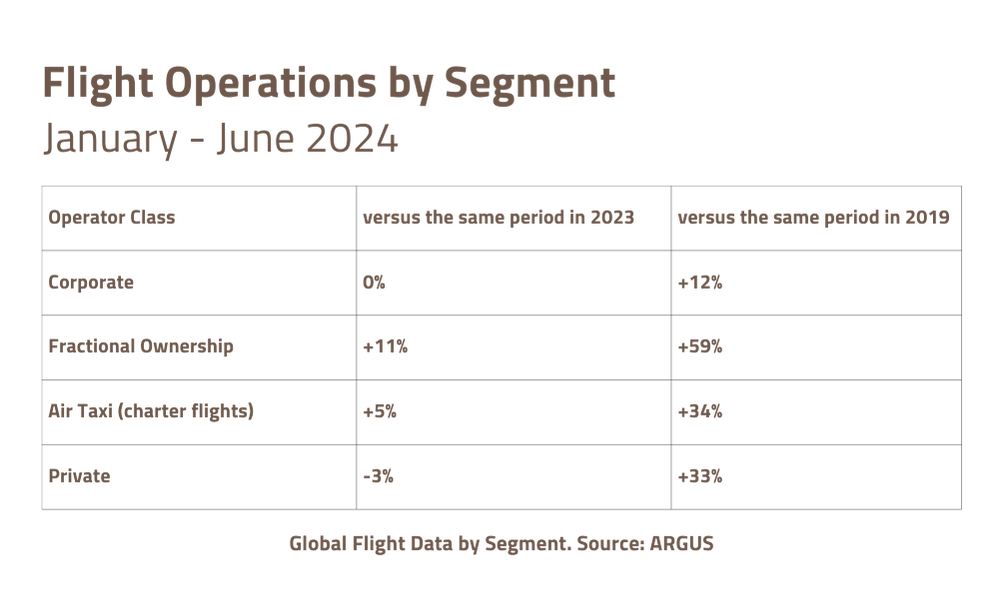

The sharing economy has also become a reality thanks to the ANAC’s regulation on fractional ownership, which became enforceable in March 2022, under RBAC 91K. These two segments — air taxis and aircraft sharing — were also identified as the fastest-growing market segments by analytics firm ARGUS, both showing year-over-year growth in Q2 2024:

Fleet Modernization

The number of executive jet deliveries significantly exceeded forecasts in the second quarter of this year. Cirium data reveals that major manufacturers delivered 151 jets, a number higher than estimated by Jefferies Equity Research. The company also forecasts that the total deliveries in 2024 will be 674 units, up from 563 in 2023.

Over the past 10 years, we have witnessed a transformation in the air taxi industry in Brazil, which has shifted from primarily serving government contracts to catering to end consumers, driving fleet renewal. With the average age of aircraft dropping from 25 to 22 years (and just 16 years in São Paulo), we have seen a significant evolution in aviation safety and service quality. Total aircraft imports in 2023 reached 657 units, compared to 476 in 2022 and 326 in 2021, according to ANAC.

“Thanks to the rapid nationalization process (1-2 days), the growing number of intermediaries, and new maintenance programs, aircraft can now be imported and maintained more easily than in the past,” says Paul Malicki of Flapper. “Brazil is gradually facing similar challenges as the US, with concerns about a lack of maintenance professionals and parts, but it is still in a better position than other markets,” adds the executive.

Sector Digitalization

“General aviation is the last major sector of the economy that hasn’t been digitalized,” said a well-known investor at the Revolution.aero conference in San Francisco in 2022. In recent years, we have seen an increase in digital solutions for the sector, including some of the following trends:

- Software that helps air taxi companies schedule flights and maintain their aircraft;

- Civil aviation authorities launching digital systems. In Brazil, ANAC now allows online submission of flight plans, storage of pilot experience history, or checking of registration numbers, making it the most advanced system in the world;

- Flight tracking software enhances transparency and facilitates market entry, providing real-time information about the aircraft and aggregating market data;

- Dedicated marketplaces now allow for almost real-time chartering of aircraft or buying/selling jets, turboprops, and helicopters.

With consumers, suppliers, and operators now able to access information more quickly and conveniently, the sector has become more professional and agile. During the next phase of sector digitalization, we expect to see new integrations between different software and significant applications of artificial intelligence. Paul Malicki states: “This means that, for example, a customer should be able to book a jet without speaking to a human. Flight costs and routes would be entirely calculated by advanced machine learning algorithms.”

Conclusion

The air taxi sector is expanding and modernizing, driven by the sharing economy, digitalization, and growing demand in emerging markets. Executive aviation continues to evolve, offering greater safety, efficiency, and accessibility to consumers. The trend is for the combination of advanced technologies and new business models to continue transforming the industry, enabling sustainable long-term growth.

Published on August 20, 2024.

Share